The Wanderer

April is Autism Awareness Month, and for those of us who have kids on the spectrum, there is a term that we’re all too familiar with- eloping.

Eloping means wandering off, bolting, escaping, or running away.

I’ve always disliked that term because I associate “eloping” with getting married, which is a joyful and happy occasion.

There is nothing joyful or happy about this type of behavior.

Eloping isn’t exclusive to kids on the spectrum, but it seems to be especially prevalent in children with autism.

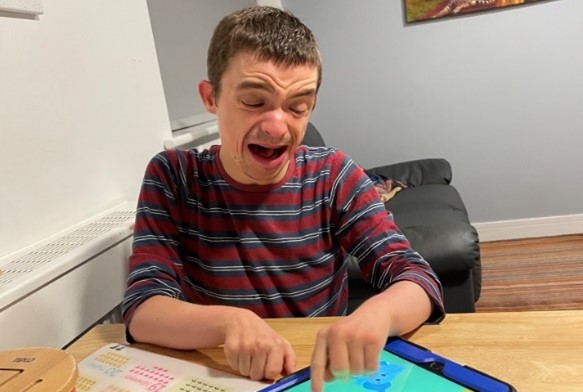

Our daughter Lilly is no exception- she’s a wanderer.

Children and adults who engage in this behavior will wander off or bolt for a variety of reasons; seeking out a preferred place, trying to avoid something that makes them anxious or uncomfortable, or they may run off spontaneously during a meltdown.

When you have a child with a tendency to wander, you’re in a constant state of hypervigilance.

Whenever we go somewhere unfamiliar, I’m constantly scoping out our surroundings for dangerous areas such as busy streets or water bodies.

I plan ahead as much as I can, looking at the location’s website and checking out the area on Google streets.

Lilly has attempted to escape from our home numerous times, and so far, our trusty chain locks have stopped her from getting too far.

Outside the house, it’s stressful.

After an incident when we were vacationing at a relative’s home where she wandered down their steep driveway to a busy street below, I always make sure she is in arm's reach when we’re at someone else’s home.

Now, at the age of 14, she doesn’t always like that, but until I can be sure she’s not going to be tempted to wander or run off, that’s how it has to be.

I have read countless news stories about autistic children wandering off, and the outcomes are often tragic.

My heart breaks a little each time because I know how easily that could have been our child.

In the wake of stories like this, there’s a tendency to blame the parents.

“Why weren’t they watching their child?”

“How can a parent be so negligent?”

“I would never let that happen to my child. I always know where they are!”

I can tell you that the day Lilly walked off while we were on vacation, there were at least three adults present within feet of her, and she still managed to quickly and quietly slip away.

It can happen to anyone, anywhere, anytime.

No one is immune, and realistically you can’t have eyes on your child 24/7 unless you plan to bring them with you every time you go to the bathroom or take a shower.

If you have a child who’s inclined to wander, creating awareness is one of the best things you can do to keep them safe.

Give your neighbors a heads-up, as well as the police.

Educate everyone you know who might be around your child for any length of time because in cases like these, it takes a village.