What do you remember?

2020 was a year that changed everything for the whole world. The past two years have been scary, between trying to keep families together and safe without knowing what lay ahead or what the outcome would be. A constant threat of contracting a virus that the medical profession knew little about. But it’s not what I primarily think of when people speak of 2020.

Why 2020 was such a bad year for us

Why? Because that was the year our son’s epilepsy and hydrocephalus went out of control. He was having almost constant seizures and needed to be transferred to resus at the regional children’s hospital on numerous occasions. It got so bad that the local paramedics would come in and say, “how many this time?” and just help me out to the ambulance. Being greeted at the doors by a resus team was terrifying. It happened more times than I care to remember. He was transferred from our closest hospital to the regional one. They felt he would need to be put into an induced coma and cared for in PICU because they just couldn’t get on top of the seizures. I really thought we were going to lose our precious boy.

We were in and out of hospital constantly and with the threat of covid-19 hanging over everyone, it added more pressure to an already desperately hard situation. It turned out he needed two shunt revisions in August within 48hrs of each other and then another in November. Despite him having seizures that do not leave him deprived of oxygen to his brain. He suffered massive regression of skills and escalation of behavioural difficulties. An MRI of his brain showed no changes, but the team felt it had all just been too much for an already compromised child to cope with.

Things have started to look up

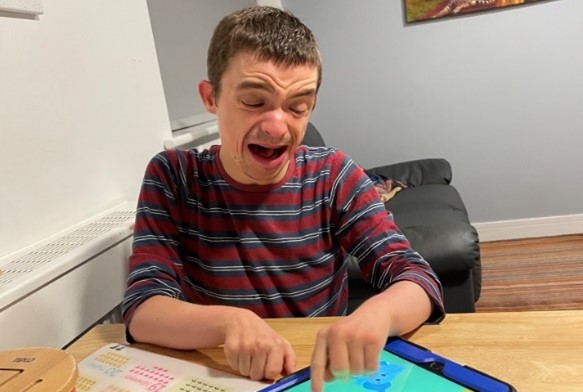

He was moved from a mainstream to special needs school after educational psychology said he was in a “trauma response” and needed pastoral care more than delivery of the curriculum. In hindsight, it was most definitely the best thing that could have been done for him. He’s now been in that school for a whole year, and we feel we’re getting our happy boy back! He is making friends, especially a special little girl who sits beside him. Apparently, they are getting married, although the jury is out on where they’d live since Jacob wants a treehouse and his love would like a castle.

As our son started to heal, I feel like I have too

I feel the teachers have just “got him” and have worked on a very simple behavioural plan that is now carried over to home as well. He has done so well with it. All we need now is a little laminate on the back of his wheelchair to visually remind him that he gets two “warnings”. Which are yellow faces, before a “consequence” of a red face. He still has meltdowns and sensory issues, as well as times where he “zones out” and can’t cope. These are getting fewer though and I feel like I know how to cope with them better. He sees a psychologist in school who he calls his friend because they play games together. She has helped him so much! As he has started to heal, I feel I have too.

We are though the worst of it now, we are so grateful

We will always remember 2020 as the year he was so unwell. But I know that millions of families across the world experienced much worse than and have lost loved ones. We feel like we are through the worst of it now and can enjoy things together as a family of five again which, is something to be hugely grateful for.