Stress Awareness Month

I can feel the vice-like panic calming inside my body, my heart rate is returning to normal and all whilst I’m thinking what can I make for tea tonight now that I forgot to take the chicken out of the freezer this morning.

You see, with anxiety there is no specific event or logical reason as to why an attack will suddenly decide to take a hold of you.

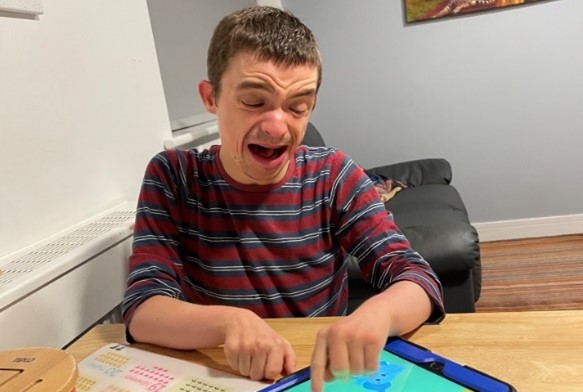

I became much more stressed as a person when my son’s hospital appointments and assessments increased pre his ASD assessment.

That was five years ago now and I feel that since then although I cope exceptionally well, I just continuously run at a slightly increased level of stress.

Stress is sometimes good though, I figured out early on that it motivated me and empowered me to fight for what my son needed and achieve my parenting goals.

Although maintaining the level of stress quickly burnt me out and brought on the anxiety.

Although stressful - I used to be elated with each milestone we achieved as a family; eating new foods, successful family days out, moving into the next reading group, a full night’s sleep etc.

I use to think that we had “cracked it”, only to realise that subsequent challenges we faced were now just different challenges not more or less.

So, the stress continued.

I tried spa days; but found this made me worse as all I could think about amongst the meditation music and scented candles was if my son was behaving in my absence, with it being a change in his routine.

I tried self-help apps for meditation and relaxation; and although these worked to a degree, I found it hard to follow the “imagine this scenario” being spoken about as my mind was wondering in every which direction and covering “what-if’s”!!

Recently in the organisation I work for there was an opportunity to complete a Mental Health First Aider (MHFA) course, to become part of a support network for people struggling with their own mental health.

I made it onto one of the 16 places from 200 applicants and the course was such an eye opener into the reality that everyone has inner demons; some bigger – some smaller, but demons none the less and everyone has their own cross to bear.

I was taught techniques to identify people in need and given tools to be able to guide them to appropriate support.

I found in doing this course; being in this environment and sharing my personal anguish and deepest concerns and experiences with total strangers really cathartic.

I realised in that moment that I’m lucky through blogging I get to share and vent a lot with the world and for me this is my coping strategy.

It’s a way for me to get down all my thoughts, worries and even hopes.

I remember after my first few blogs my husband said to me that up until that point he had never realised how hurt and affected I had been from our son’s diagnosis, I realised that I never shared the load with him and this is what had led to my stress and anxiety.

Bottling up the emotions does not work and is not healthy, yes we all deal with stress and that’s everyday life but we cannot let this rule or consume us.

It’s important to identify what our own triggers are and try to take preventative steps before our health and wellbeing is affected.