Coming Out Of Lockdown - The Child Mental Health Cost & what We Can Do About It

We’ve been warned about it, we’ve seen it coming, maybe we’ve experienced it in our own family situation. The evidence is all too clear and stark. We might be coming towards the end of lockdown restrictions, ‘Freedom Day’ as some like to call it. However, we are only just fully understanding the toll that the last 16 months has had on the mental health and wellbeing of our children. ‘Freedom’ seems a long way off for many.

Surveys, studies and research results are flooding in...

They share very challenging results. These include studies by The Disabled Children’s Partnership (DCP) of which I’m a member; as well as Sibs, which is the support organisation for brothers and sisters of children with additional needs. We need to be aware of this data as it helps us to understand and help our children better. To journey with them as we help them back from the mental health challenges that many of them are experiencing. Here are some of the ‘highlights’ from the studies:

The same report highlighted that due to delays to appointments and meetings; over half of children had experienced their condition worsening and their development stopping. It continued by showing that over half of children had lost the confidence to go outside of their homes. 40% had lost confidence in interacting socially with even familiar people like friends and family. All of this has resulted in 33% of parents saying that their disabled child now has depression.

As recently as April this year; 75% of disabled children were socially isolated. A further two thirds of them were not getting the support they were legally entitled to (DCP #LeftInLockdown report).

And this hasn’t been restricted to disabled children themselves. Sibs report that 81% of siblings’ mental health has become worse during lockdown, with 40% feeling isolated. This loneliness can often be because of having to shield to protect their brother or sister. Parents are affected in a similar way, with the Disabled Children’s Partnership reporting 60% of parents experiencing social isolation. It’s stark reading; I realise that, and we can’t just leave it there without some thoughts about what we can do to make a difference to these figures.

So, here’s my seven ‘top tips’ to help us help our family to improve our overall mental health:

1. Exercise! Try to get your bodies moving. That might be anything from a walk around the block to a full blown Joe Wicks style workout (they’re still out there on the Internet!). The more we move the better our mood, so get moving!

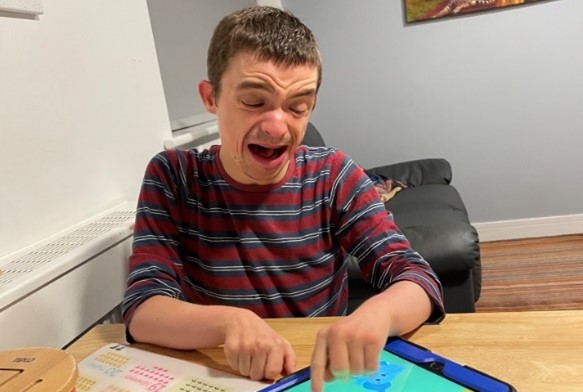

2. Exercise your minds too! Keep your brains active. That could be by doing puzzles, playing games, reading or telling stories. It could be anything that makes you all work those little grey cells a bit.

3. Eat well! For many, It’s been easy to fall into bad eating habits during lockdown. Comfort food can often seem to be a remedy for low mood. To resolve this, eating a balanced, healthy diet can make a real difference both to our bodies and minds. Drink plenty of water too.

"Seeing their face if only on a screen, will help us feel less isolated and alone."

4. Go outside or let the outside in! The first lockdown was accompanied by some fantastic weather! Most of us were able to get outside and get our children outside and we benefitted from it. Since then, the weather has been less helpful, but some fresh air and a glimpse of sunshine can still lift our mental health. Even opening a window and letting the fresh air in can make a difference.

5. Talk with people! OK, we may still not all be able to see people like we would like to, but we might be able to phone, Zoom, FaceTime or whatever works for you. Hearing a loved one’s voice, seeing their face if only on a screen, will help us feel less isolated and alone. If we can visit friends and family safely then make the most of those opportunities. Days without social contact can affect most of us, but if we keep in touch we can keep on top.

6. Have fun! Make sure there is time each day for the things you and your children enjoy doing. If that’s watching TV or having time on the Xbox then don’t beat yourself up about it. Your mental health will thank you for it. Go easy on yourselves, some days just getting through without anyone being lost or killed is a win!

7. Look for the positives and celebrate them. Did something go well today, if so what was it? What made you or your child smile? Were there any wins? Focus on them, celebrate them, and repeat them!

Let’s be active, in every way, and look after ours and our children’s well-being!

By keeping an eye on our own mental health and that of our children's, we can help to limit the impact that the last 16 months will otherwise have had. Let’s be active, in every way, and look after ours and our children’s well-being! And remember, you’re not facing this alone, there are lots of us out there trying to get through this too. Why not check in on some additional needs support groups, online groups, and even other families that you know. In fact, you can work through this together with other people that ‘get it’ too.

Cheering you on!

Mark